Vavada казино - регистрация, вход и зеркало

Авторизованный вход на официальный сайт Вавада обеспечивает доступ к огромной коллекции игровых автоматов, в которой содержится свыше 5000 вариантов развлечений. Их поставляют 46 компаний, известных качеством софта и его высоким уровнем отдачи, поэтому на платформе азарта собраны аппараты со средним RTP 96%, красочной графикой и продуманными сюжетами. Они способны увлечь каждого и принести много выигрышных выпадений с щедрыми множителями. Чтобы ничего не отвлекало от главной цели пребывания на портале, его страницы предлагают удобную навигацию, простой процесс выполнения разных функций и универсальность сервиса. Гемблеры из разных стран выбирают язык интерфейса из 18 вариантов, открывают депозит в любой из 22 валют и пользуются 17 способами для пополнения и вывода средств со счета. После регистрации в casino Vavada они автоматически становятся участниками бонусной программы и многоуровневой системы лояльности. Активный геймплей приносит игрокам бесплатные ставки, участие в розыгрышах на фриспины с крупными призовыми фондами, увеличенные лимиты кэшаута и помощь личных менеджеров.

| 🕹️ Игровая платформа | Вавада |

| 🎯Дата открытия | 13.10.2017 |

| 🎰 Топовые провайдеры | NetEnt, Igrosoft, Novomatic, Betsoft, EGT, Evolution Gaming, Thunderkick, Microgaming, Quickspin |

| 🃏Тип казино | Браузерная, мобильная, live-версии |

| 🍋Операционная система | Android, iOS, Windows |

| 💎Приветственные бонусы | 100 фриспинов + 100% к первому депозиту |

| ⚡Способы регистрации | Через email, телефон, соц. сети |

| 💲Игровые валюты | Рубли, евро, доллары, гривны |

| 💱Минимальная сумма депозита | 50 рублей |

| 💹Минимальная сумма выплаты | 1000 рублей |

| 💳Платёжные инструменты | Visa/MasterCard, SMS, Moneta.ru, Webmoney, Neteller, Skrill |

| 💸Поддерживаемый язык | Русский |

| ☝Круглосуточная служба поддержки | Email, live-чат, телефон |

Признаки, отличающие сайт Вавада от казино мошенников

Сегодня попасть на подделку аферистов может каждый, ведь их количество увеличивается пропорционально с ростом популярности онлайн-гемблинга. Чтобы не стать жертвой обмана, при поиске легального заведения приходится быть внимательным к деталям. Посетители легко смогут отличить поддельную платформу от оригинала по таким признакам:

- Лицензия Кюрасао в открытом доступе. Документ доступен каждому гостю и клиенту азартного клуба. Они свободно изучают юридическую информацию и проверяют регистрационный номер соглашения на наличие в реестре. На сайте Vavada Online лицензионный договор расположен в футере страницы.

- Соблюдение принципов ответственной игры. Казино акцентирует внимание на лимитировании потраченных средств и времени, проведенного в игре. Кроме этого, добросовестные азартные заведения не допускают к развлечениям на деньги людей младше 18 лет. В подвале веб-ресурса это правило наглядно демонстрируется.

- Web-площадка не перегружена рекламой и лишней информацией. Главная цель казино — обеспечить игроков честным и качественным процессом погони за выигрышами. За исключением информационного баннера и кликабельных кнопок на разные разделы, страница посвящена симуляторам.

- Возможность играть на Вавада бесплатно. Чтобы запустить барабаны, не обязательно пополнять депозитный счет. В демо-версиях играют на виртуальную валюту.

- Служба поддержки. При обращении в саппорт становится понятно, что общение происходит не с чат ботом, а с грамотным специалистом. Операторы вежливо, развернуто и доходчиво объясняют непонятные моменты и пути решения затруднений.

Скриптовые платформы обычно отличаются и оформлением. Их выдает невнимание к деталям дизайна, устаревшие иконки игровых автоматов и скудный функционал ресурса.

Регистарация на ВавадаСпособы поиска нового зеркала, вход в casino Vavada на сегодня

Зеркальные сайты используются гражданами тех стран, где азартные ресурсы блокируются по требованиям законодательства. Точные копии онлайн-казино продолжают работать за счет измененного доменного адреса, который скрывает принадлежность страницы к сервису для развлечений на деньги. Они функционируют на тех же условиях, что и основной портал, предлагают аналогичный ассортимент игрового контента, навигацию и сервисные возможности. Поэтому посетители и клиенты заведения совсем не заметят разницы от использования дубликата и официальной площадки.

Чтобы воспользоваться копией, нужно найти актуальный домен. Для поиска игроки используют системы Яндекс или Гугл, заходят на порталы-обзорники и форумы. Они всегда могут предложить список ссылок на рабочее зеркало Вавада на вечер, но среди них могут находиться и подделки мошенников. Лучше обратиться к официальным источникам таким, как публичные сообщества клуба в Инстаграм, Телеграм и Вконтакте. Их администраторы регулярно обновляют списки URL-адресов в публикациях и высылают зеркала по первому требованию подписчиков.

Список рабочих зеркал Вавада

Вход на сайт Вавада: пошаговая инструкция регистрации

Чтобы пользоваться всеми возможностями веб-казино, необходимо авторизоваться в системе сервиса. Процесс довольно простой и займет не больше пары минут. Потребуется выполнить следующее:

- Открыть online casino в браузере компьютера или мобильного устройства, либо скачать независимое приложение.

- Найти красную кнопку с надписью «Регистрация» и кликнуть по ней.

- Заполнить регистрационную форму. Ввести имейл, который в последующем выступает в качестве логина, и надежный пароль.

- Открыть депозит путем выбора подходящей валюты.

- Подтвердить ознакомление с правилами и условиями конфиденциальности заведения.

- Кликом на кнопку в нижней части окна завершить регистрацию на Vavada com.

Чтобы заверить логин, перейдите в профиль персонального офиса. В верхнем его окне пройдите подтверждение электронной почты и заполните профильную анкету. По желанию верифицируйте учетную запись. Для этого в соответствующем поле профиля вставьте копии паспорта или любого другого документа, который идентифицирует личность. Эту процедуру можете не выполнять, поскольку администрация разрешает игрокам пользоваться ресурсом анонимно.

Лучшие слоты на Вавада

| 🔥 Бездепозитный бонус: | 100 фриспинов |

| 💻 Официальный сайт: | vavada.com |

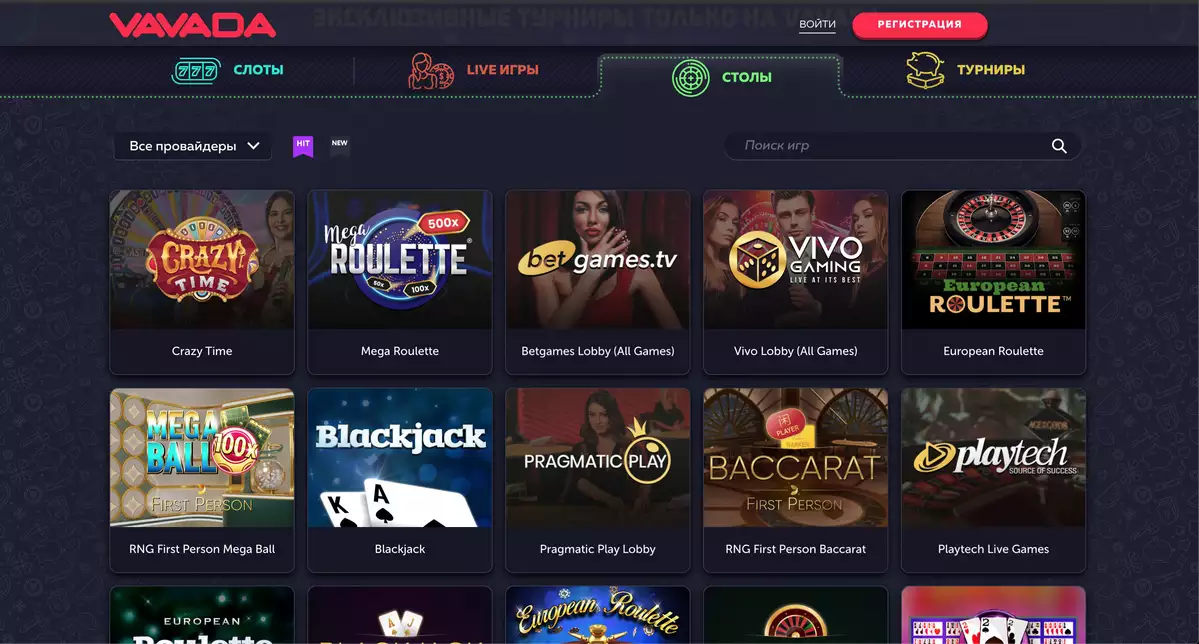

| 🎲 Тип казино: | Слоты, Столы, Live, Турниры |

| 🗓 Рабочее зеркало: | Есть |

Какие бонусы и промокоды Вавада входят в программу поощрения новичков и постоянных клиентов казино

Чтобы мотивировать геймеров на активное времяпровождение, клуб дарит бесплатные спины и фишки, а также денежные прибавки для использования в виртуальных автоматах. Они дают возможность срывать куш без финансовых трат и выводить его на лояльных условиях. В пакет вознаграждений входят такие подарки:

Сто free spins за регистрацию

Бездеп разрешается применять только в барабане Great Pigsby Magaways. Он предлагает увлекательный сюжет и отдачу 96%, поэтому фриспины порадуют новичка и принесут гарантированную прибыль. Перед выводом куша его следует отыграть с вейджером х20. Чтобы это сделать, понадобится пополнить депозит на сумму большую выигрыша в 20 раз и потратить ее в любых слотах. С момента активации бонуса casino Vavada при регистрации до вывода у гемблера есть 14 дней. По их истечению поощрение сгорает.

Двойной множитель на депозит

Первый взнос денег в кошелек также отмечается бонусным подарком. Платеж удваивается если его сумма находится в рамках от 1$ до 1000$. Буст приходит на дополнительный баланс и расходуются в первоочередном порядке перед основным счетом на любых аппаратах игротеки. Для отыгрыша указан вейджер х35. Период действия денежного буста — 14 дней.

Промокоды

Те, кто хотят получить промокод Вавада 2023, активно запускают симуляторы, участвуют в розыгрышах и акциях соцсетей, заходят на стримы партнеров портала и подписываются на новостную рассылку. Размер бонуса и его условия геймеры узнают после активации. Некоторые коды активируются единожды, другие заряжены на несколько активаций.

Кэшбэк

Десять процентов от потраченных денег приходят на бонусный баланс в первых числах месяца и доступны для использования по усмотрению владельца. Как и остальные вознаграждения, кэшбэк следует отыграть с коэффициентом х5.

Турниры Vavada

На платформе можно играть в слоты Вавада на заносы либо войти в раздел с турнирными сражениями и вступить в борьбу за крупные валютные призы и автомобили. Турниры предлагают разные форматы соревнований такие, как:

- Икс-состязание. В сражении принимают участие все игроки без исключений. Они запускают слот-машины из представленного списка и делают ставки, используя валюту. Те, кто сорвал наибольшие множители становятся победителями. Их число варьируется от условий соревнования и доходит до 150 человек, занявших верхние позиции турнирной таблицы. Для них клуб подготавливает призовой фонд до 65000$.

- X-Plus. Турнир Вавада отличается от предыдущего одним нюансом: в рейтинг заносятся множители от 100 и выше. Призовой фонд — 50000$.

- Кэш турнир для бронзовых. Соревнование с ограниченным допуском. Оно отличается от других использованием бесплатных ставок в виде фишек. Капитал для победителей составляет 25000$.

- Фриспин-турнир для серебряных. Мастера гемблинга используют один симулятор от начала и до конца сражения, делая ставки с помощью выданных спинов. Призеры награждаются фондом 25000$.

- MaxBet. Единственный формат, в котором учитываются не заносы, а сделанные ставки. Они суммируются на протяжении всего соревнования, наибольшие суммы определяют призеров. Сто человек разделяют капитал в размере 50000$.

Для проведения эксклюзивных розыгрышей автомобилей Vavada Official выбирает несколько форматов соревнований. Перед Новым Годом клиенты заведения сражались в Икс, МаксБет и Икс-плюс турнирах за пять Мерседесов. Осталось последнее состязание за внедорожник Gelandewagen. Оно пройдет с 25 по 31 декабря в формате за наибольшие ставки.

Лайв игры на Вавада

Острые ощущения азарта и соперничества дают не только турнирные соревнования, но и live игры Вавада. Это прямые трансляции настольных развлечений таких, как рулетка, баккара, покер, кости, монополия, лото, блэкджек и адаптация популярных барабанов. В роли ведущего выступает профессиональный крупье. Он ожидает геймеров в специально оборудованной студии, чтобы объяснить правила столов, принять ставки и следить за правильным выполнением процесса игры. Дилер общается с участниками онлайн-трансляции на русском и английском языках. В лобби провайдеров этот параметр можно выбрать в соответствующих подразделах. Чтобы играть в Vavada live, придется пополнить депозит от 1$. Бонусные спины и виртуальную валюту дилер не принимает. Но это не повод расстраиваться, поскольку разброс стоимости бетов предполагает возможность бюджетного геймплея.

Демо игры — играть бесплатно на Vavada

Демонстрационные версии слот-машин — это способ играть на Вавада без финансового риска. Запустить симуляторы могут как зарегистрированные пользователи, так и посетители платформы. Они пользуются теми же характеристиками геймплея, что и игроки в платных версиях, но для вращений применяют виртуальные денежные единицы. Демо игра Вавады не принесет прибыли, но доставит удовольствие ценителям качественного гемблинга и позволит начинающим геймерам набраться опыта.

Для запуска тест-режима нужно навести курсор мыши на иконку слота и кликнуть по кнопке, которая всплывет в середине. Если ее нет, то автомат не предполагает бесплатные ставки.

Кошелек — инструмент для проведения платежей на Vavada

В этом разделе клиентского кабинета гемблеры меняют валюту депозитного счета, делают пополнение, перевод средств на учетные записи других пользователей, извлекают выигрыши с виртуального баланса и следят за историей операций. Все эти функции выполняются довольно просто, поскольку страницы вкладок оборудованы большим выбором финансовых сервисов и кликабельными кнопками. Потребуется всего пара кликов, чтобы ввести или вывести деньги со счета.

Как вывести деньги с Вавада

Транзакция проводится с таким порядком действий:

- Открыть соответствующую страницу кошелька.

- Выбрать удобный способ вывода из банковских карт, криптовалютных и цифровых провайдеров.

- Указать размер платежа (доступный минимум 20$).

- Ввести реквизиты.

- Отправить сформированную заявку на рассмотрение.

Обработку запросов на извлечение выигранных средств проводят специалисты финансового отдела. На это уходит от 5 минут до 24 часов.

Как пополнить счет Vavada

Пополнение баланса можно выполнить по такому же алгоритму во вкладке кошелька с одноименным названием. Одобрение получают платежи от 1$ и выше. В списке финансовых систем присутствуют те же операторы для проведения платежных транзакций. Они способствуют мгновенному зачислению средств и не взимают комиссий.

Джекпоты казино Вавада: три уровня главного приза

Если клиент заведения вращает барабаны и делает денежные ставки в топовых настолках, он автоматически претендует на один из джекпотов. Это может быть небольшой Минор, который выпадает с частой периодичностью, оттого его сумма не так велика по сравнению с другими призами. На сегодня копилка Минора составляет 65$. Теоретически любая ставка сорвет Мажор с капиталом 7150$ либо Мега джекпот, счетчик которого насчитывает 210000$. Он не стоит на месте, поэтому сумма изменяется ежеминутно. Следить за размером куша можно при взгляде на центральный баннер.

Официальный сайт VavadaFAQ

Как выиграть в Вавада?

Нет стопроцентно верной стратегии, так как все игровые автоматы портала подчиняются случайным результатам ГСЧ. Но если делать больше вращений хитовых барабанов, запускать лайвы и не пропускать турниры, то шансы на выигрыш увеличиваются в разы.

Как получить кэшбэк в казино Vavada?

Cashback начисляется исключительно тем гемблерам, которые по итогам статистики за 30 дней игрового процесса ушли в минус в соотношении выигранных и проигранных средств.

Как зайти на сайт Вавада?

Для авторизации зарегистрированные пользователи используют логин и пароль или двойную аутентификацию с помощью дополнительного шестизначного кода. Она настраивается в профиле личного кабинета. Чтобы включить автоматический вход без ввода данных, нужно поставить галочку рядом с надписью «Запомнить меня». Она находится в поле авторизации.

Отзывы

-

Я пользуюсь сайтом уже более полугода и все потому что слоты дают заносы, которые реально вывести.

-

Играю в телефоне, что очень удобно. Если дома не посидишь нормально за компом, то мобильная версия выручает. Сейчас прогу можно скачать на любой девайс.

-

Мне нравится то, что есть возможность менять развлечения. Надоедают слоты, запускаю лайвы. Там наигралась включаю Авиатор или подобные ему игры и так далее.

-

Проблем не обнаружил. Vavada вполне подходящая для новичков и опытных игроков площадка.

-

Подписался на все соцсети, но мне мало активности. Хочется больше акций и в общем какой-то движухи.